Illinois state transportation funding is generated from a variety of sources. This funding goes to the Illinois Department of Transportation (IDOT), local governments, and transit agencies to address maintenance, construction, and administrative needs.

Illinois’ Primary Transportation Funding Sources

With the exception of motor fuel taxes, these revenue sources are largely divided between the Road Fund (63%) and State Construction Account Fund (37%) to support state transportation projects and administration. The exact distribution of all of these funding sources and additional detail on Illinois’ transportation funding can be found in the ILEPI report titled, “Illinois Transportation Revenue, Expenditures, and Projects: An Analysis of Rebuild Illinois and Past Funding.”

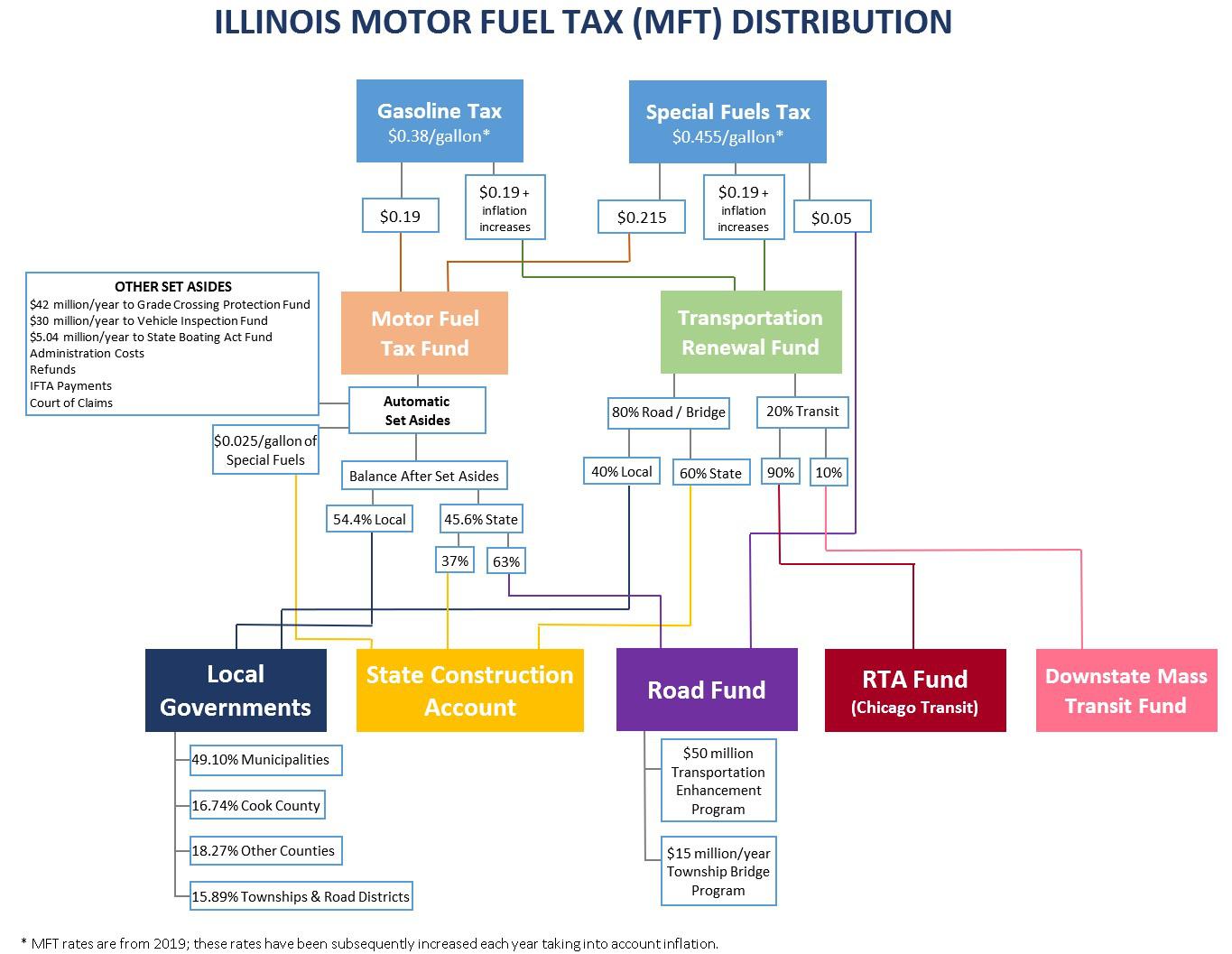

Motor Fuel Taxes

The motor fuel tax (MFT) is the most significant transportation funding source for Illinois. It generates the most money, approximately $2.5 billion per year. The MFT was recently increased in 2019 under Rebuild Illinois. Additionally, the MFT is increased each July 1, with rates tied to inflation. The rate increases by an amount equal to the percentage increase in the CPI-U.

The MFT is unique from other transportation fees in that a substantial portion of the funding is distributed to local governments. As shown below, of the funding going to local governments, municipalities receive 49.10%, Cook County receives 16.74%, all other counties receive 18.27%, and townships and road districts receive 15.89%. For Fiscal Year 2022 (July 1, 2021 – June 30, 2022), counties received over $319 million, municipalities received over $448 million, and townships and road districts received over $144 million. As a result of motor fuel tax increases under Rebuild Illinois, these disbursement increased 66% beginning in FY2020 compared to FY 2019.

Transit agencies also receive a portion of Illinois’ MFT funds. As a result of Rebuild Illinois, transit agencies now receive dedicated annual capital funds for the first time in state history. The Regional Transportation Authority (RTA)– which oversees the Chicago Transit Authority (CTA), Pace suburban bus, and Metra commuter rail– receives 90% of transit funding from the Transportation Renewal Fund. The Downstate Mass Transportation Fund– which supplies grants to downstate public transportation agencies– receives 10% of total transit funding from the MFT.

A portion of revenue from the sales tax on motor fuel is also dedicated to transportation funding. Following changes under Rebuild Illinois, the revenue from sales tax on motor fuel was incrementally moved to the Road Fund beginning in July 2021. The transition of this revenue will be complete by July 1, 2025. Total annual revenue will fluctuate depending on the price of fuel. Additional details on this can be found on ILEPI’s Rebuild Illinois Sales Tax on Motor Fuels page.

Distribution of Illinois Motor Fuel Tax (MFT)

State Transportation Funds

Road Fund

Funding for IDOT administration, expenses for construction and reconstruction projects and certain public transportation expenses.

State Construction Account

Funding exclusively for construction, reconstruction, and maintenance of the state maintained highway system (cannot be used for MFT administration or payroll).

Featured Work:

The Impact of Electric Vehicles and Increased Fuel Efficiency on Transportation Funding

January 16, 2023 |

Policy BriefIllinois Transportation Revenue, Expenditures, and Projects: An Analysis of Rebuild Illinois and Past Funding

July 21, 2022 |Infrastructure Investment and Jobs Act: Transportation Funding Summary for Illinois

March 29, 2022 |Forecasting Bumpy Roads Ahead: An Assessment of Illinois Transportation Needs

April 4, 2018 |COVID-19 and Transportation Funding in Illinois

May 6, 2020 |